Original author: @burstingbagel

The DeFi market is picking up. Crypto researcher @burstingbagel shared 13 DeFi start-up projects on social media. BlockBeats translated them as follows.

Entangle Protocol

Entangle Protocol is the first cross-chain protocol that leverages synthetic derivatives to synergize liquidity and add value to liquidity in common Layer1 and Layer2 ecosystems. Simply put, the protocol allows users to seamlessly interact with liquidity pools across chains.

dAMM Finance

dAMM Finance provides secure under-collateralized loans to market makers with good on-chain credit history. Market making is capital-intensive and generally has to be over-collateralized. dAMM Finance's under-collateralized credit to keep lenders' funds safe.

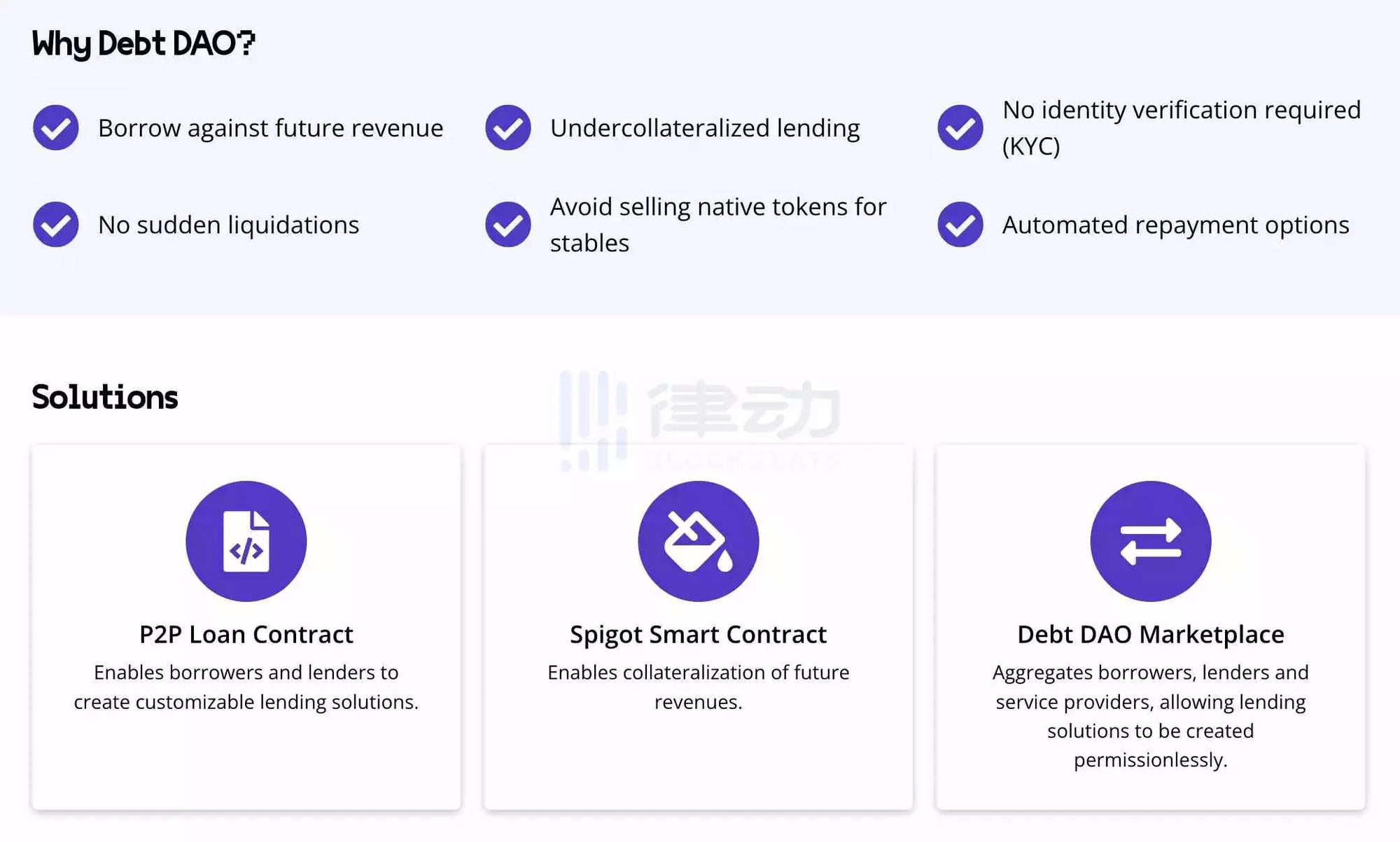

Debt DAO

Debt DAO also provides under-collateralized loan services. Their approach is to provide both borrowers and lenders with income-based financing contracts. The income generated by the borrower's product or service will automatically repay the principal and interest accrued on the borrower's loan.

Split

Split is creating an automated arbitrage DEX aggregator with innovative trading tools. The protocol aims to provide the masses with a convenient arbitrage tool, which will mean a better DEX trading experience. Features currently planned to be developed by the protocol include: Gasless trading, floating stop loss tools, and copy trading.

Abacus

Abacus is creating an NFT valuation system. Accurate assessment of NFTs will allow for better composability and capital efficiency of NFT financial products such as NFT-based loans. NFT project parties can evaluate their collectibles by obtaining veABC to incentivize the agreement.

Guzzolene Finance

If you know the story between Curve and Convex well, it is not difficult to understand Guzzolene Finance. The protocol is like Abacus' Convex.

Gradient

Gradient is an NFT loan that can be based on any NFT. Note that it is any NFT, including 1/1 NFT. The protocol does this by integrating with Abacus. Notice the trend here?

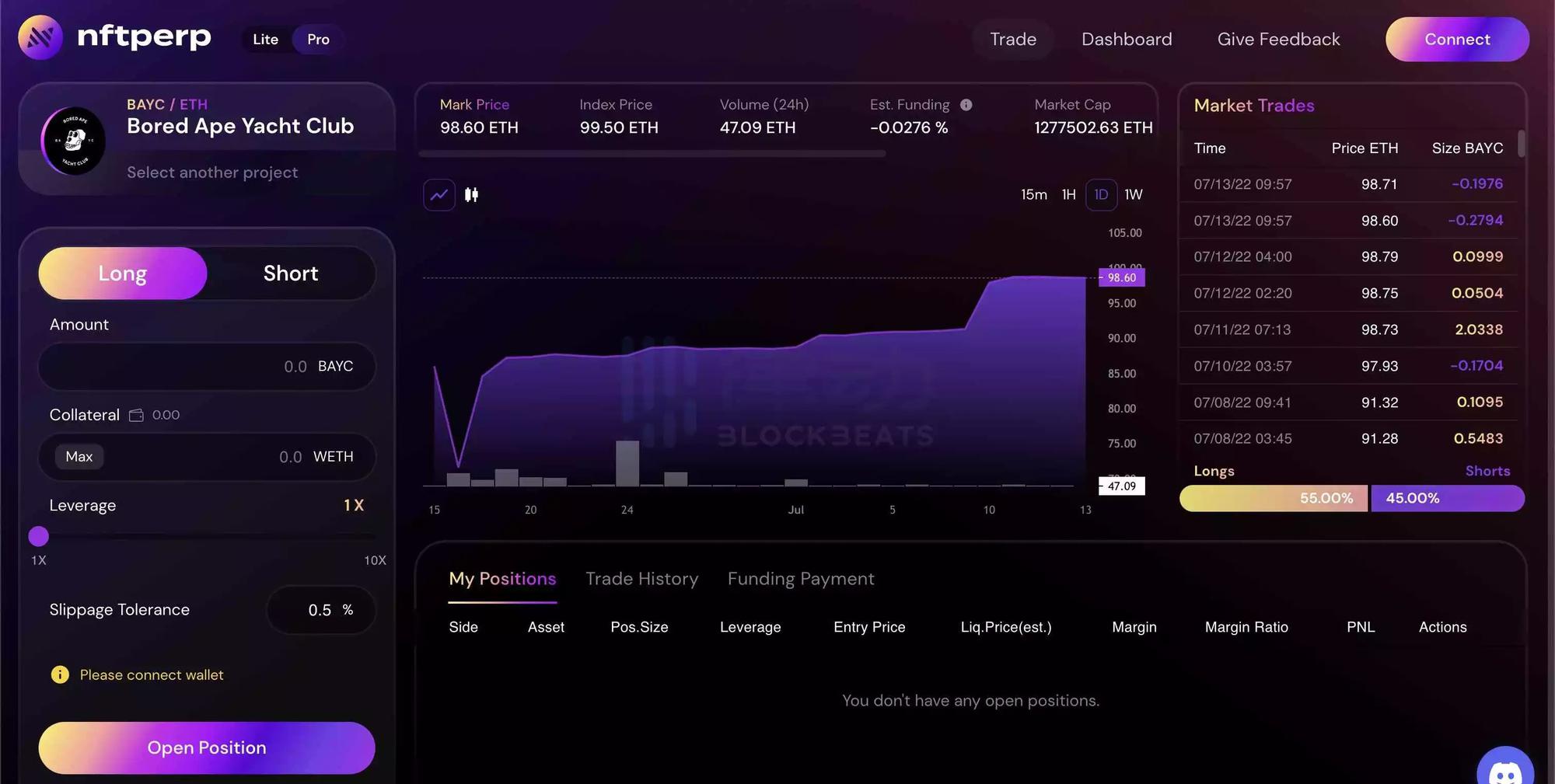

nftperp

nftperp, as the name suggests, is a protocol that provides perpetual contract trading of NFTs on the Arbitrum network. It's about time someone created an easy way to go long or short NFTs and hedge positions. It is said that some people use NFTs with low volatility for airdrop mining. The APR seems to be quite high.

Mimicry Protocol

Mimicry Protocol is an NFT prediction market running on a global collateral pool. This enables unlimited liquidity while trading with zero slippage.

Timeless Finance

Timeless Finance tokenizes the yield, while allowing users to increase the yield, hedge the yield and even trade future yield changes. There's a lot of room to combine with other defi protocols here. Looking forward to the final result of the team.

Y2K Finance

Y2K Finance allows users to fundamentally go long or short the risks involved in different Stablecoins. Basically, if you're anticipating a breakaway event or want to protect yourself while earning money, this might be the place for you.

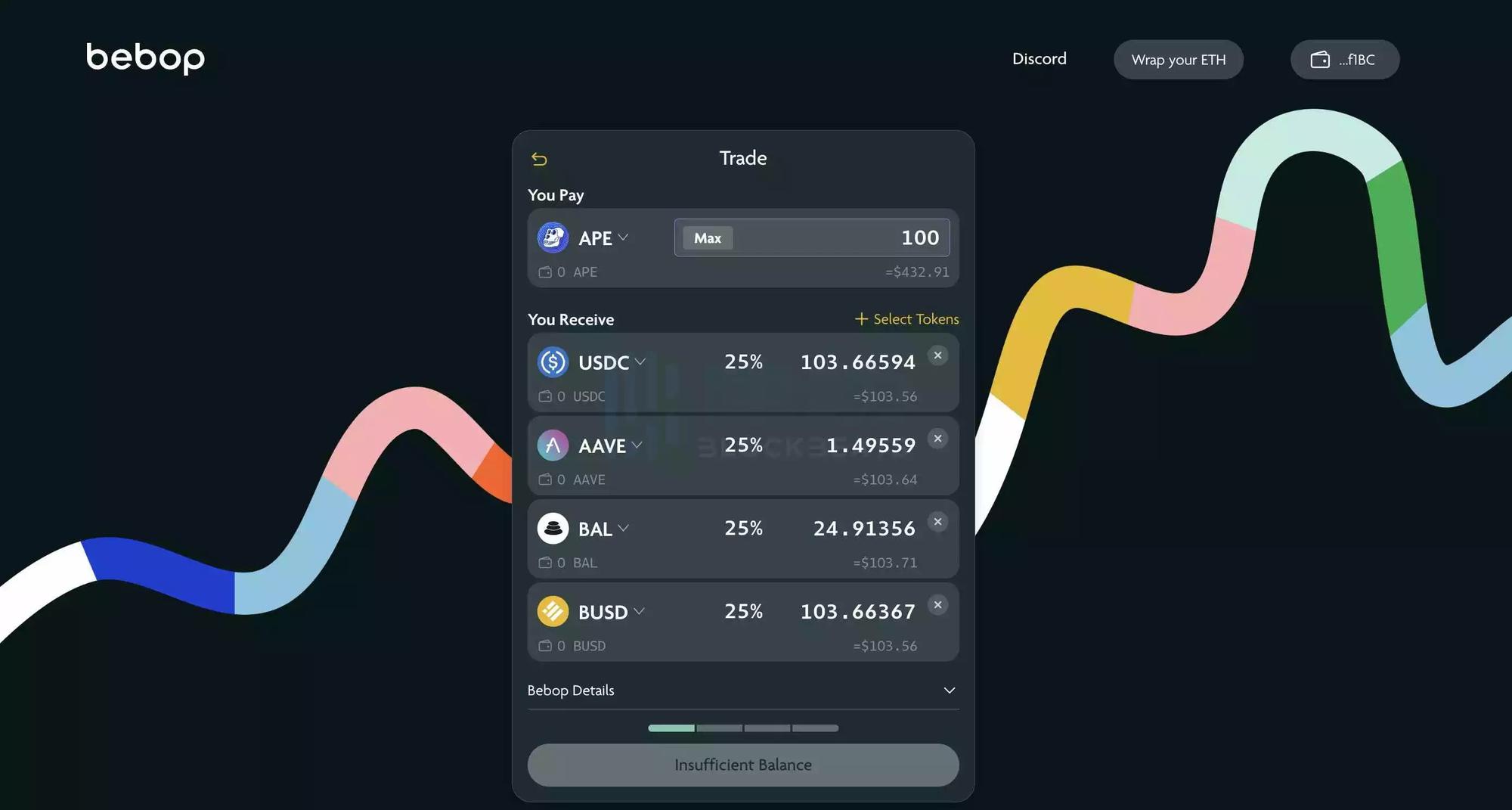

Bebop

Bebop is a zero-slippage decentralized trading platform and supports the trading of one asset for multiple assets and vice versa. UI and UX are nice.

Golom

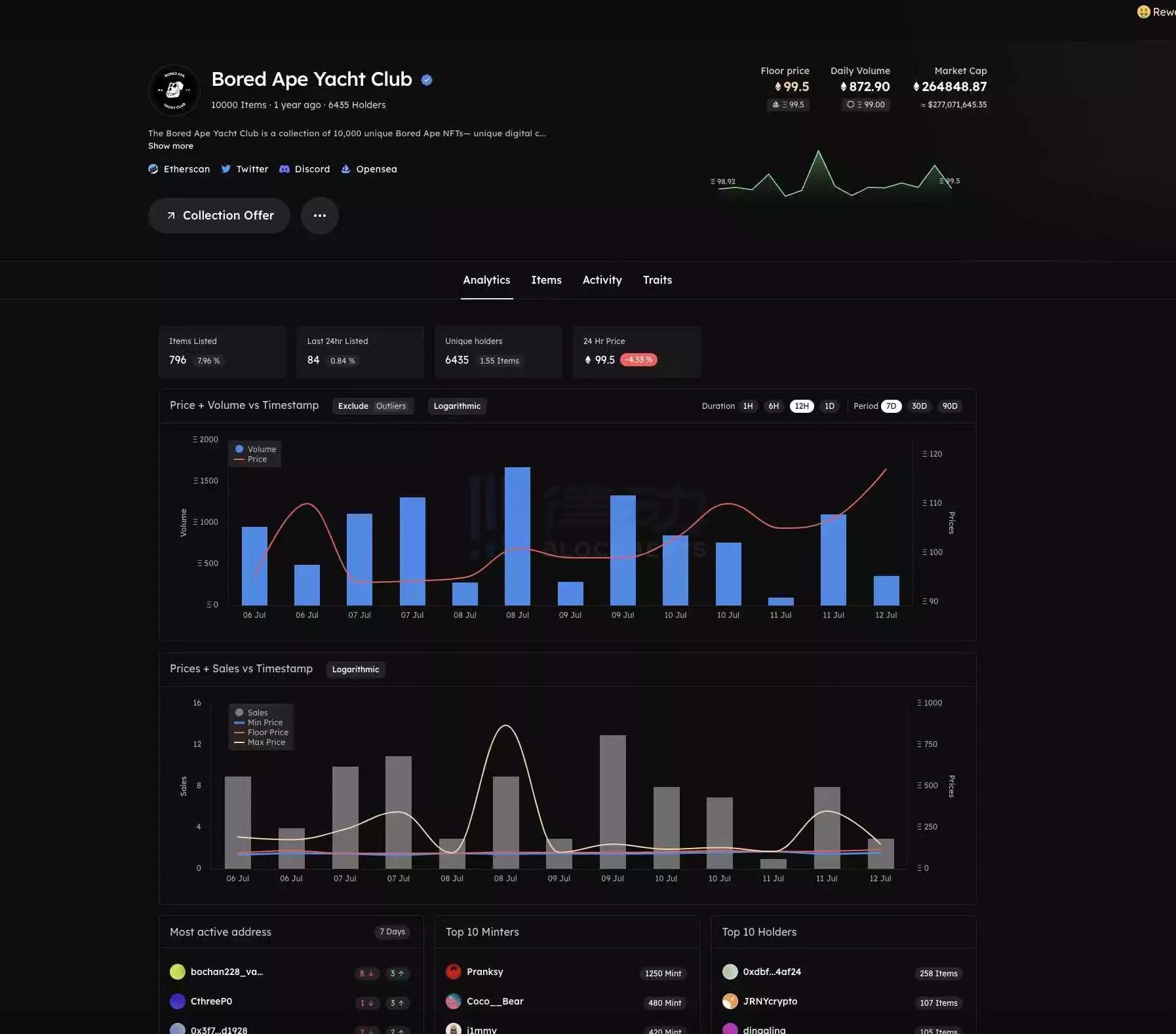

Golom is an NFT trading market that aggregates pending order information from different NFT markets and provides analysis of high-quality NFT projects. Token pledgers can receive 0.5% of the transaction on the platform as a profit. Kind of like a combination of Blur and LooksRare. Genesis Trading is live.